Buying is Smarter Than Renting at Texas A&M

A Message to the Parents of Texas A&M Students – Out of State!

As a College Station Realtor, my greatest areas of expertise are in student housing, working with the parents of TAMU students and investment property acquisition. Qualifying for in-state residency during your time at Texas A&M can prove to be both financially and academically beneficial. As of the 2023-2024 academic year, gaining in-state residency can lower a student’s tuition by $28,000 per year. Click here to learn more about in-state/out-of-state tuition rates. Buying a College Station home for your student not only qualifies them as an in-state resident within 12 months, but also provides rent avoidance, tax advantages, and investment potential as well. In addition, College Station property values have appreciated an average of 4.5% annually for the last 27 consecutive years. In other words, historically speaking, College Station has consistently been a quality real estate market for decades. From a real estate experience standpoint, I personally own local rental property and have used my experiences to help a tremendous number of parents of Texas A&M students purchase their own properties. As a Texas A&M graduate myself, I truly enjoy the process of finding and acquiring these types of properties, and I would love to share my knowledge and experience with you. Please contact me at your earliest convenience (979) 325-8119 or [email protected] to discuss this information further.

Qualifying for In-State Residency Status

I need to make clear, I am not a Texas A&M employee, and do not personally approve your application for in-state residency. I am, however, very familiar with this process and passing along beneficial information in hopes that we can work together, with the common goal of improving your student’s overall academic experience during their time at Texas A&M. I encourage you to reach out to me by phone to discuss your student’s specific situation. Mae Ishmael (979) 325-8119. In addition, please review the important links below:

Establishing Residency:

Application:

https://aggieonestop.tamu.edu/getmedia/52dec9c2-2c5f-4814-9a68-797cafdda8dd/Residency.pdf

Registrar’s office contact information:

Office of the Registrar | Texas A&M University

[email protected]

(979) 845-1085

Buying a Student Home Vs Paying Traditional College Rent

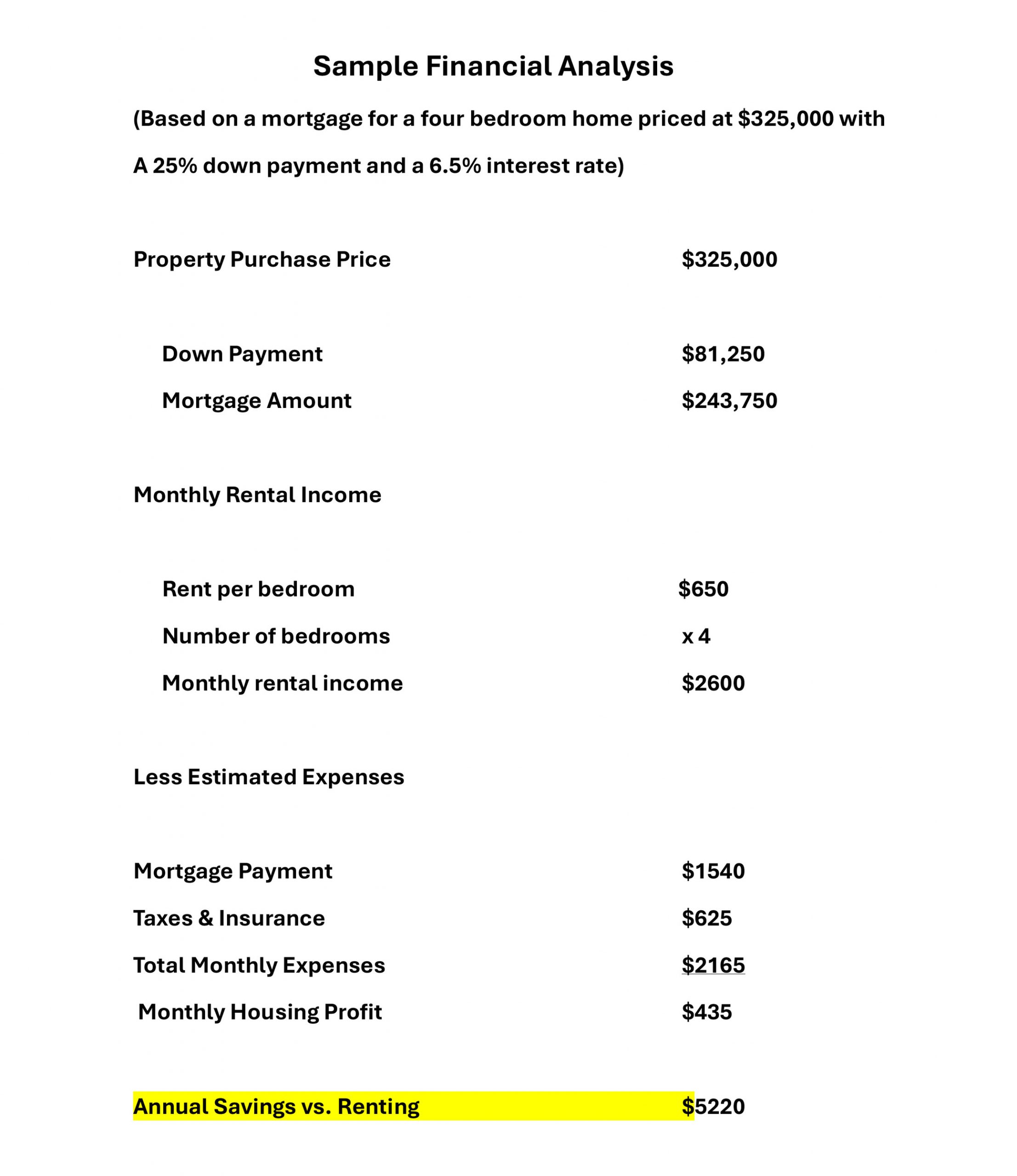

There are significant bonus reasons for owning your Texas A&M student’s home. Student housing is the single largest controllable college expense. Quality, near campus rentals in College Station are costly – commonly starting at $650/month per bedroom ($7,800 a year) and go much higher. In most cases, this represents 40%+ of an in-state student’s annual educational budget! Some students pay in excess of $1000/month per bedroom for premium housing close to campus.

Unlike renting, property ownership can provide significant cost reductions and tax advantages. As a parent, rental payments from your student’s roommates reduce your expenses and allows your student to live at a lower cost. The tax advantages can be substantial, and I can share with you how those have benefited me personally. Please take a moment to consider these numbers:

As you can see, the potential financial benefits are clear. Gaining in-state residency by purchasing a student home can be a game changer. There are also other tangible benefits. As an Aggie parent, you understand that a student’s safety and academic setting are critical to their well-being and success. Both of these can be greatly enhanced by living in a privately-owned house, condo or townhome, where the surroundings are quiet and the parking is close. Please call, text or reach out to me using the contact form below to discuss your student’s specific situation and needs.

Contact Mae to find out more about owning a home for your Aggie.